Mobile apps have turned into a strong power across each industry, and the money and banking area is no special case. The fast reception of digital arrangements is reforming the manner in which shoppers cooperate with monetary establishments. Whether it’s moving cash, applying for credits, or following costs, mobile apps offer uncommon accommodation and availability. This blog will investigate how these developments are molding the fate of banking, while at the same time giving experiences into how the top mobile app development companies in Chicago and mobile app development services in California are driving the charge.

1. The Developing Interest for Money and Banking apps

With the ascent of fintech and the rising movement towards a credit-only economy, money and banking apps have become fundamental for current customers. Computerized wallets, digital money exchanging stages, and mobile financial services are presently incorporated into day-to-day existence. Subsequently, the two banks and new businesses are joining forces with the top mobile app development companies in Chicago to make creative arrangements that take special care of these advancing requests.

Apps like these permit clients to:

- Access monetary services day in and day out.

- Make speedy and secure exchanges.

- Screen individual budgets progressively.

- Get customized monetary bits of knowledge.

These services offer accommodation and constant advantages that customary financial frameworks need, powering the interest for master mobile app development services in California to make consistent, easy-to-use encounters.

2. Key Highlights Driving Monetary app Development

The outcome of money and banking apps relies intensely upon the mix of state-of-the-art features that improve both usefulness and security. Here are a few key elements that are molding the development of mobile money apps:

- Biometric Validation: With security being a top concern, biometric highlights, for example, unique marks or facial acknowledgment, are presently standard in numerous apps.

- Man-made intelligence Fueled Examination: simulated intelligence apparatuses assist clients with dealing with their funds by giving experiences into ways of managing money, offering planning tips, and anticipating future monetary patterns.

- Blockchain and digital currencies: Many money apps currently incorporate digital money exchanging, with blockchain technology being coordinated for secure exchanges.

- Moment Installment Choices: Consistent installments through choices like Apple Pay, Google Pay, and other mobile wallets are fundamental to keeping clients locked in.

To convey these high-level elements, companies frequently team up with the top mobile app development companies in Chicago and depend on creative mobile app development services in California that have some expertise in secure, adaptable stages.

3. mobile apps and the Shift Toward a credit-only Economy

Quite possibly the main change in the money business is the shift toward a credit-only economy. Mobile installment apps, like PayPal, Venmo, and Zelle, have acquired inescapable acknowledgment and have pushed monetary establishments to reexamine conventional financial cycles. These apps permit clients to move cash easily, pay for labor and products, and, surprisingly, split bills—all without requiring actual money.

This shift is to a great extent powered by the openness of cell phones and the ascent of the digital installment foundation. Accordingly, mobile app development services in California are zeroing in on making apps that help this credit-only pattern, guaranteeing they are secure, dependable, and easy to use. All the while, the top mobile app development companies in Chicago are driving in creating custom answers for monetary establishments, hoping to embrace this digital change.

4. The Job of simulated intelligence and Mechanization in Money apps

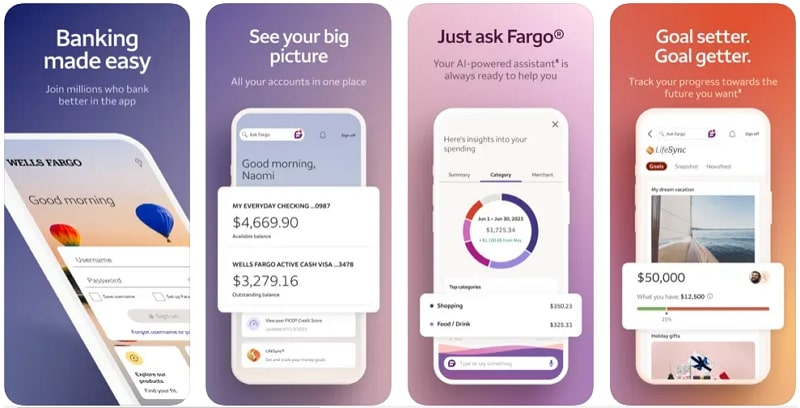

Man-made consciousness (man-made intelligence) and computerization are assuming an essential part in the development of mobile money apps. These advances empower apps to perform undertakings like customized planning, misrepresentation recognition, and robotized monetary preparation. Man-made intelligence chatbots are turning into a well-known instrument for client support, permitting clients to immediately find solutions to monetary inquiries.

This is the way man-made intelligence is changing money and banking apps:

- Computerized monetary service: simulated intelligence-controlled apps give clients bits of knowledge on spending examples and proposition reserve fund tips.

- Extortion Identification: AI calculations can distinguish dubious exercises and tell clients progressively, forestalling unapproved exchanges.

- Customized Financial Experience: man-made intelligence tailors the client experience by offering redid monetary exhortation, advance choices, and venture proposals in light of the client’s monetary information.

By utilizing computer-based intelligence, Mobile app development services in California are making natural and responsive apps that can expect client needs. In the mean time, the top mobile app development companies in Chicago are spearheading better approaches to coordinate computerization for a consistent client experience.

5. Security Difficulties in Money and Banking apps

Security is a first concern in money and banking apps, as they handle delicate client information, for example, ledger numbers, individual recognizable proof, and exchange chronicles. In the age of digital dangers, designers are entrusted with mobile app ideas that focus on hearty safety efforts.

Some normal security highlights include:

- Start to finish Encryption: Guarantees that information sent among clients and servers is secure.

- Multifaceted Validation (MFA): Adds an additional layer of safety by expecting clients to confirm their personality through more than one technique.

- Misrepresentation Identification Frameworks: Ongoing observation of client action to distinguish and hinder deceitful exchanges.

Engineers at the top mobile app development companies in Chicago are knowledgeable in carrying out these basic safety efforts. Furthermore, mobile app development services in California is continually refreshing and refining security conventions to stay aware of arising dangers in the fintech space.

6. The Eventual fate of mobile Money apps

The eventual fate of mobile money and banking apps looks encouraging, with patterns highlighting more customized and coordinated services. Monetary foundations are supposed to take on more computer-based intelligence-driven devices, extend digital currency abilities, and spotlight cross-stage openness.

Before long, we can anticipate:

- More extensive Reception of Decentralized Money (DeFi): DeFi apps permit clients to loan, acquire, and contribute without requiring mediators like banks.

- Upgraded Client Personalization: Artificial intelligence and AI will empower more custom-made monetary guidance and venture potential open doors.

- More noteworthy Spotlight on Inclusivity: Money apps will take care of underserved populations by offering reasonable, open monetary arrangements.

By remaining in front of these patterns, the top mobile app development companies in Chicago and mobile app development services in California will keep on driving the charge in changing the money and banking industry.

Read more: How To Build An App Like Pandora: Its Cost, Features, And Process

Conclusion

Mobile apps are at the very front of the continuous change in the money and banking area. With inventive highlights, an emphasis on security, and the reception of man-made intelligence, these apps are setting new norms for comfort and effectiveness. As requests keep on developing, companies will depend on the skill of the top mobile app development companies in Chicago and the ground-breaking mobile app development services in California to make earth-shattering arrangements that shape the eventual fate of money.